Livingston County Consortium on Aging

|

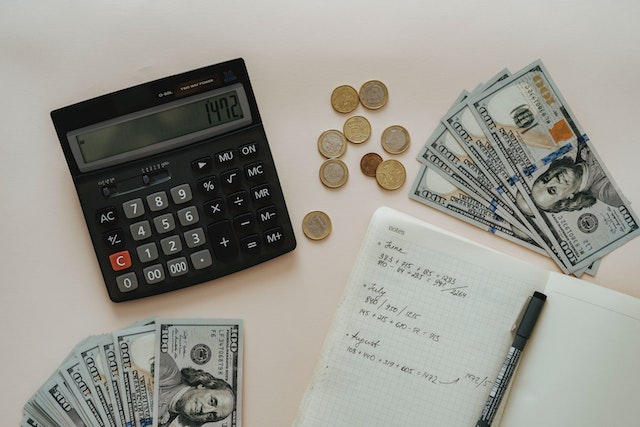

Most people dread the idea of getting old. They only think about the potential health issues and loneliness that they’ll have to face. But instead of focusing on the downsides, you should consider the upsides. You’ll have fewer responsibilities, which translates into less stress and a lot of free time to do whatever your heart desires. Still, if you want to be happy and fulfilled after 50, you must start planning early. Being well-prepared will enable you to enjoy retirement at its fullest. So, take a look at these seven steps to take when preparing for retirement. No. 1 One of the first steps to take when preparing for retirement is to assess your finances and start saving. As a general rule, it’s never too soon to start saving for retirement. However, the first step you need to take is to assess your finances. Factor in everything from your current income and expenses to your assets and debts. This will enable you to determine where you stand. Once you have a clear understanding of your current financial situation, it’s time to think strategically. For instance, you should focus on lowering your debt or paying it out entirely before you retire. Otherwise, you won’t be able to afford the retirement lifestyle you dream about. At the same time, you should think of ways to cut down your current spending because this will enable you to save more for your retirement. No. 2 Do some research on retirement benefits. Firstly, you should do some research on retirement plans. In the US, you can opt for both government and private retirement plans. Nevertheless, you must get well-informed on the terms and conditions of contribution and withdrawal. Otherwise, you risk getting less than expected once you retire. Secondly, you should do some research on some of the best states to retire in that offer lower living costs or tax benefits for retirees. No. 3 Identify your retirement needs and income sources. Don’t fool yourself into thinking that retirement comes cheap. According to the experts, you’ll need around 70-80 percent of your pre-retirement income to maintain your current living standard. And if you also want to travel the world, you’ll probably need a bit more. So, think about how you want to spend your retirement and identify your wants and needs. Then, consider all your retirement income sources to see what you’ll be able to afford. If you want more, you might want to consider working after retirement. It doesn’t have to be a full-time job, just a side gig to increase your retirement income. No. 4 Create an emergency fund. Having an emergency fund is a great idea even when you’re young, but it’s a necessity when you’re old. While nobody likes to think about it, you become more prone to accidents and health issues as you age. And medical bills can easily bankrupt you. Apart from this, you never know when your car will break down, or you’ll need to replace the roof. Therefore, it’s best to have a separate savings account for these types of emergencies. No. 5 Determine if your current home is fit for retirement. One of the essential steps to take when preparing for retirement is to carefully assess your home and determine if it meets your retirement needs. Firstly, think about the size of your home. Since your kids are all grown up, you no longer need so much space. Plus, it will become increasingly harder to clean and maintain as you age. Not to mention that a big home comes with high expenses. Thus, you should consider downsizing. Secondly, you should think about the safety of your home. You never know what the future will bring, but it’s best to be prepared. For example, you should remodel your bathroom and replace slippery floors around your home. You should senior-proof your home to reduce the risk of accidents, tailor the space to your needs, and consider moving out during the renovation— if you want to take on an extensive remodeling project. No. 6 Think about your health. Many employers offer health insurance policies. However, once you retire, you’re all on your own. Thus, you should go and get checked up as soon as possible. If you require any medical interventions, it’s best to do them before you retire. Furthermore, you should look into health insurance options for retirees to identify the best policy for you. At the same time, you should also focus on improving your health. Give up any bad habits and start living healthily. This entails eating right and exercising regularly. Doing this can prevent or reduce the risk of developing various health issues. This, in turn, will enable you to enjoy your retirement and do all the things you wish to do. No. 7 Look for ways to make retirement fun Many people fear that they’ll have too much free time on their hands and nothing to do with it once they retire. If you’re one of them, start looking for ways to make retirement fun. There are plenty of fun hobby ideas to choose from. Here are some examples:

In conclusion Aging is inevitable, but instead of dreading it, you should think about all the benefits that it brings. No more stressful jobs and small kids to take care of, and a lot of free time to do the things you’ve always dreamed about. However, to achieve this, you have to start planning early. So, follow these seven steps to take when preparing for retirement.

0 Comments

Leave a Reply. |

|